Wakefield & Associates: Scam Debt Collector?

Wakefield and Associates is not a scam debt collector agency. If you owe money and Wakefield and Associates are after you, they might keep calling you from different numbers non-stop. They could also try to scare you on social media, send unfriendly letters, and use other questionable tactics.

What Is Wakefield And Associates

Wakefield and Associates is a company that specializes in collecting debts for various organizations like banks, schools, and hospitals. They play a bit of a name game, appearing under different names such as “Wakefield Payment Solutions” or “Wakeassoc.” Essentially, they act as the middleman, trying to get individuals to settle their unpaid bills with different companies.

How Wakefield Works

Wakefield & Associates basically make money by going after people who owe money. They do this by dealing directly with the people who owe, buying debts from others at a low price, and getting involved early in the whole debt process.

They buy debts from different places like businesses, schools, finance companies, healthcare providers, and property managers. If you miss a payment, Wakefield & Associates can legally contact you to try and get you to pay up. They can also put a mark on your credit report, and this can seriously mess up your credit score for up to seven years, even if you pay off everything you owe. So, it’s smart to sort these situations out fast to avoid messing up your credit for a long time.

Is Wakefield And Associates A Scam?

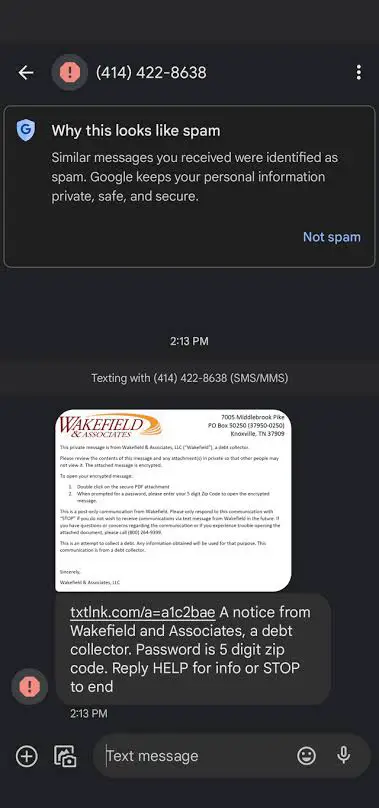

Wakefield & Associates is not a scam. They’re a real debt collection agency, and they have to follow the rules. Legitimate agencies, like them, are obligated to do things the right way and stick to the law while collecting debts. However some people have reported receiving malicious text messages from a number claiming to be Wakefied and Associates. The text says ‘A notice from Wakefield and Associates, a debt collector. Password is 5 digit zip code. Reply HELP for info or STOP to end.” The phone number listed is (201) 949-7446. Also a user on Reddit said

I received a letter in the mail from a debt collection company by name of Wakefield and Associates mentioning that they are the new creditor of the debt that they “bought from the original creditor”. On that same day, they called me by phone asking if I was willing to settle the debt. I told them I need to verify that they are in fact the actual debt collectors of this debt, out of security reasons as I had been victim of identity theft in the past. The representative swore up and down that they hold the debt and asking for payment of nearly $600. I told the representative that I don’t feel comfortable in providing payment information over the phone and that I would make the payment securely online.

Jane

How Do I Get Rid Of Wakefield And Associates

Check if You Really Owe the Money

Instead of ignoring Wakefield & Associates, ask them to prove you owe the money by sending a letter. According to the rules, they have to show evidence. If they can’t, they might have to remove it from your credit history. Remember, you have 30 days to send this letter, and it’s a good idea to use certified mail for proof.

Try to Make a Deal

If it’s been more than 30 days or they can prove you owe the money, see if you can work out a deal. Negotiate with Wakefield & Associates to pay less than the full amount in exchange for erasing the debt from your credit report. Start talking about paying around half of what you owe. After you pay, keep an eye on your credit report to make sure they actually remove it.

Get Some Help if You Need It

If dealing with Wakefield & Associates is too much, think about getting help from a credit repair company. They can handle the talking, arguing, and settling with Wakefield & Associates on your behalf. Whether you do it yourself or get help, act quickly to improve your credit. With these steps, you can hopefully get Wakefield & Associates off your credit report without too much hassle.

Wakefield And Associates Customer Complaints

If Wakefield & Associates is getting on your nerves, you’re in good company. Loads of people have filed complaints against them.

On the Better Business Bureau (BBB) website, there are hundreds of complaints about Wakefield & Associates. It gets even worse – the Consumer Financial Protection Bureau (CFPB) has received thousands of complaints about them. People are mostly angry about them reporting stuff wrong, being a pain, or not checking if a debt is legit.

How To Contact Wakefield and Associates

Here’s how you can reach out to Wakefield and Associates:

Give them a ring in Colorado at 1-800-864-3870 or, if you’re reaching out from Tennessee, dial 1-800-264-9399.

If you prefer the old-fashioned way, you can drop them a line or pay a visit at 7005 Middlebrook Pike, Knoxville, TN 37909.

How To Spot Debt Collection Scams

Pushy Tactics

Legit debt collectors does not use scary languages or threats. If they’re saying stuff like jail time or harm, it’s likely a scam.

Lack of Contact Information

Legit debt collectors have identifiable information. If the caller refuses to provide their company’s name, address, and phone number, it’s a red flag.

Unrecognized Debt

If you don’t recognize the debt they claim you owe, ask for details. Scammers might pressure you into paying for a fictitious debt.

Missing Formal Notification

Real debt collectors send written notifications within five days of initial contact. If you’re not receiving formal letters, it could be a sign of a scam.

Unusual Payment Methods

Be careful especially if asked to pay with prepaid cards or money transfers. Scammers like to use untraceable payments. Legit debt collectors have more secure payment options.

Illegal Threats

Genuine collectors cannot disclose your debt details to others. If a scammer threatens to inform your employer or family, it’s a violation of the law.

How To Protect Yourself From Debt Collections Scams

Contact Your Creditor

Verify the debt with your creditor to ensure legitimacy.

Check Credit Report

Review your credit reports for the mentioned debt.

Avoid Disclosing Information

Only share information already known to the potential scammer.

Know Your Rights

Legitimate debt collectors should provide documentation. Understand your state’s statute of limitations on debt.

How To Report Debt Collection Scams

Maintain Records

Keep a record of all communication with collectors.

Contact State Attorney General

Reach out to your state’s attorney general to report the scam.

Submit Complaints

Report fake debt collectors to the FTC and CFPB online or by phone.

Read also: Topsetters.com

Conclusion

Wakefield and Associates is not a scam, however if someone claims you owe money and acts really pushy, it might be a scam. Legit collectors give you their details, but scammers avoid it. If they’re after a debt you don’t recognize or don’t send proper letters, be cautious. Stay alert!

Frequently Asked Questions

Why Am I Getting Calls from Wakefield and Associates?

Wakefield and Associates is reaching out because they’re a debt collection agency. Their job is to collect money you owe to different organizations, like banks, schools, and hospitals.

Who Does Wakefield and Associates Collect For?

They usually work with companies in healthcare. This includes hospitals, ERs, doctors’ groups, medical transport facilities, behavioral health centers, and more.